By Jason Wiseman —

Money. That often times misused, misquoted, elusive, and abused currency in our lives.

Ever wonder why the rich seem to get richer and the poor get poorer?

Did you take a How Money Works class in school? Will you learn it in college? Not likely.

Money is misunderstood. It’s a tool. No different than a hammer.

You can use a hammer to drive nails and build shelter. You can also use it to break a window and steal. Is it the hammers fault? Of course not. It’s the person swinging it who is responsible.

And with Money, just like the hammer, education is the key ingredient to how it is used, how it grows, and how it can be leveraged for good!

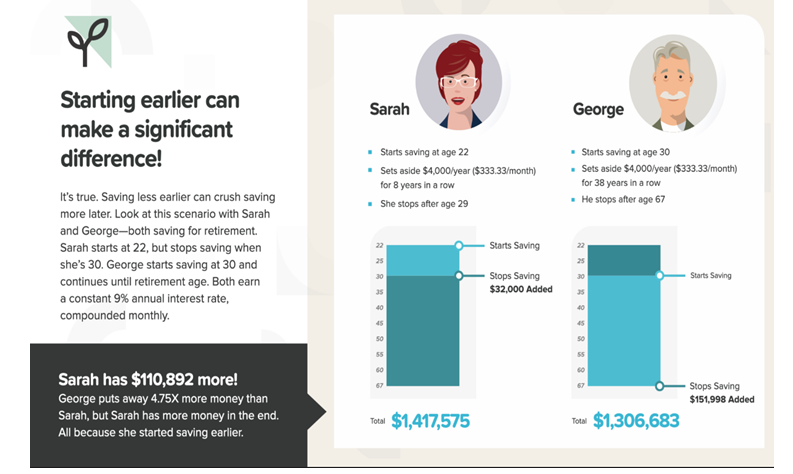

After over a decade of providing money education and financial advice, there are two concepts, when combined, continue to resonate and get people excited about money: Compound interest and the Rule of 72! Lets start with Compound Interest-The combination of compounding and the power of time!*

As you can see in our example, Sarah was smart! By starting early, staying committed, letting interest and time work for her, she accomplished the same thing as poor old George for a fraction of the cost!

Albert Einstein has been quoted as saying compound interest is the greatest mathematical discovery of all time. And now, you know why!

What would your future be like if you started saving $100, $200, $300 a month and you took advantage of compound interest and time? Dream a little! Because next, you will see how to dream BIG.

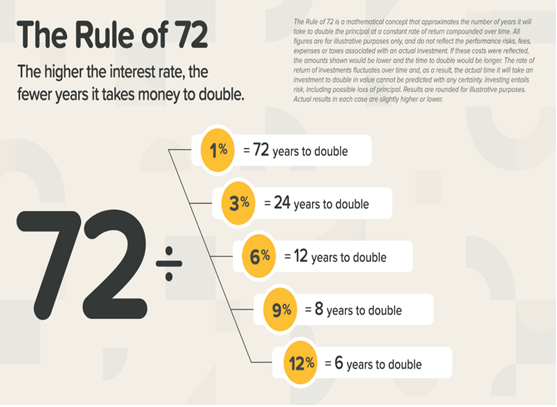

Math and Numbers scare you a bit? Right? Don’t worry! Here is the magic math to solve your anxiety:

The Rule of 72!*

This is money magic! You’ll always know if your money is working hard for you or not! These are the lessons the likes of John D Rockefeller learned, at a very young age that helped him go on to build a fortune. It’s been said he was the world’s first billionaire!

If he learned these lessons at the age of 14 and implemented them, then so can you!

In closing, here are a few other tips:

- Live below your income. No matter how much money you make, be it a little or a lot, make sure your expenses are under that number.

- Pay yourself first. 10% minimum on your entire pay before taxes.

- Start young. Even your very first job as a teenager. You have zero obligations, so why not do it?

- Create habits. Just like brushing your teeth keeps you away from the dentist as much as possible, having good money habits can keep you out of poverty.

- Make it Automatic-auto pay yourself to another account. Same day every pay day.

- When the time comes to invest, work with a professional. My wealth increased significantly when I began working with a professional.

- Stick to the plan!!! The wealthiest people you will meet in your life likely started early, saved, invested regularly, and never quit.

- Its boring in the early years. Yes it’s boring. Do an exercise for yourself: Start with the number 2 and double it, then again (4), and again (8). Do this 30 times. Write it out. Look where the biggest gains happen. I am not going to ruin it for you. You do it and see the magic of time and compounding.

- Never, never, never, EVER, stop learning.

Click here for more money tips.

Remember: Money isn’t the problem. Its what you do with it that’s the problem.

*************************************************************************************************************

Jason Wiseman is a Senior Marketing Director with WealthWave, LLC. He is a resident of Arizona and enjoys spending time with his wife and two college-age children.